PCB Global Market Space is Vast

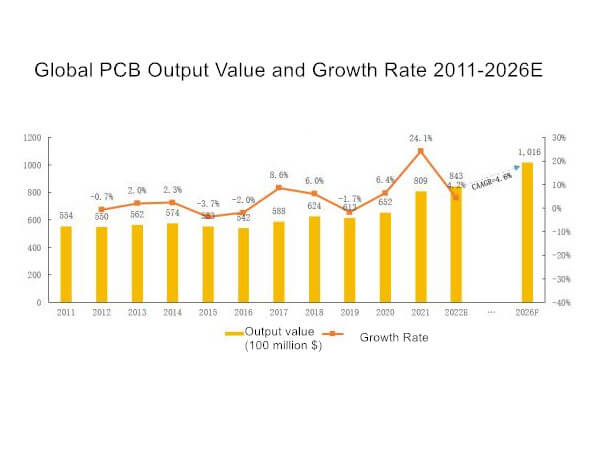

The PCB industry is the industry with the largest output value among the global electronic component subdivision industries. In 2017 and 2018, the global PCB output value grew rapidly, with an increase of 8.6% and 6.0% respectively. Due to the weak macroeconomic performance and the impact of the Sino-US trade war, the global PCB output value in 2019 decreased by 1.7% compared with the previous year.

Affected by the prevention and control of the new crown epidemic in 2020, scenarios such as home office and home study will stimulate demand for personal computers, consumer electronics, and network communications, and the gradual recovery of automobile production and demand in the second half of 2020 will drive PCB demand to pick up. According to Prismark statistics, the total output value of the global PCB industry in 2021 will be US$80.92 billion, an increase of 24.1% over 2020.

Driven by factors such as intelligence and low carbonization, PCB downstream application industries such as 5G communications, cloud computing, smart phones, smart cars, and new energy vehicles are expected to flourish, and the vigorous development of downstream application industries will drive continued growth in PCB demand . According to Prismark’s forecast, the total output value of the global PCB industry will increase by 4.2% in 2022; the global PCB market will maintain moderate growth in the next five years, with a compound annual growth rate of 4.6% from 2021 to 2026.

The Global PCB Industry is Shifting to Asia, Especially Mainland China

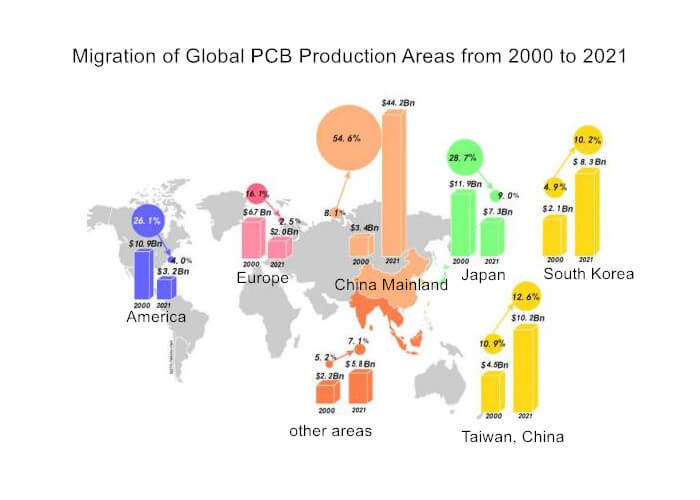

The PCB industry is widely distributed around the world. The developed countries in the United States, Europe and Japan started early, developed and fully utilized advanced technical equipment, and the PCB industry has made great progress. Before 2000, the three major regions of America, Europe and Japan accounted for more than 70% of the output value of global PCB production and were the most important production bases. In the past two decades, relying on the advantages of Asia, especially mainland China, in labor, resources, policies, and industrial agglomeration, the global electronics manufacturing capacity has been transferred to mainland China and other Asian regions. With the transfer of the global industrial center to Asia, the PCB industry presents a new pattern with Asia, especially mainland China as the manufacturing center. Since 2006, mainland China has surpassed Japan to become the world’s largest PCB production region, and the output and value of PCB rank first in the world.

As the largest production area in the global PCB industry, mainland China has accounted for 54.6% of the global PCB output value from 8.1% in 2000 to 54.6% in 2021. The PCB industry in regions and other places has developed rapidly.

Development Trend

Prismark expects the output value growth of each country and region in the next five years to be as follows

Country And Region | 2021(USD million) | 2026F(USD million) | Compound Growth Rate |

China Mainland | 44150 | 54605 | 4.3% |

Japan | 7308 | 9102 | 4.5% |

America | 3246 | 3880 | 3.6% |

Europe | 2002 | 2381 | 3.5% |

Asia(Except China Mainland and Japan) | 24215 | 31591 | 5.5% |

Total | 80920 | 101559 | 4.6% |

According to Prismark’s prediction, Asia will continue to dominate the development of the global PCB market in the next five years, and the core position of mainland China will be more stable. The PCB industry in mainland China will maintain a compound growth rate of 4.3%. By 2026, the total industry output value will reach 54.605 billion Dollar. Driven by the growth of the high-end packaging substrate market, the compound annual growth rate of PCB output value in mainland China and Japan has remained at a relatively high level.

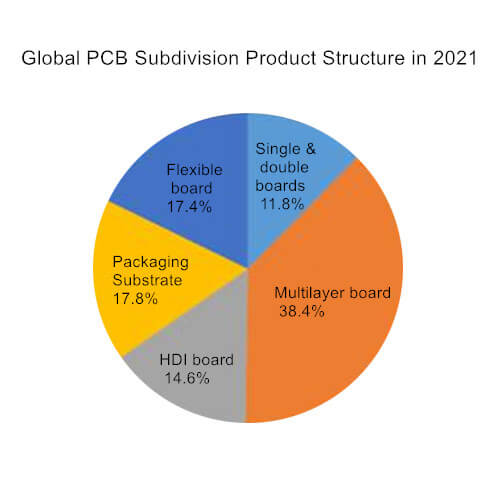

Global PCB Segment Product Structure

Rigid boards have the largest market size, of which multi-layer boards account for 38.4%, single- and double-sided boards account for 11.8%; packaging substrates account for 17.8%; flexible boards and HDI boards account for 17.4% and 14.6% respectively.

With the rapid development of technology in the electronic circuit industry, the integration functions of components are becoming more and more extensive, and the high-density requirements of electronic products for PCBs are more prominent. In the next five years, driven by consumer electronics, automotive electronics and computers, packaging substrates, HDI boards and multilayer boards will grow rapidly. According to Prismark’s forecast, the compound growth rate of packaging substrates from 2021 to 2026 will be about 8.3%, leading the PCB industry; the compound annual growth rate of HDI boards will be 4.9%.

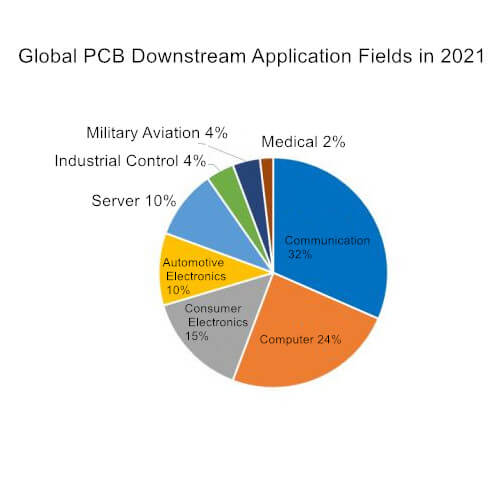

Global PCB Downstream Application Fields

The global PCB downstream application market is widely distributed, mainly including communications, computers, consumer electronics, automotive electronics, servers and data storage, military aviation, industrial control, medical equipment and other fields.

The vigorous development of the electronic information industry is an important boost to the development of the PCB industry. With the development of next-generation information technologies such as big data, cloud computing, and 5G communications, the demand for servers and data storage is growing rapidly. According to data from Prismark, the output value of PCBs in the global server and data storage field is US$5.893 billion in 2020, and is expected to reach US$8.859 billion in 2025, with a compound annual growth rate of 8.5%, faster than other application fields.

With the increase in the penetration rate of new energy vehicles and the rate of automotive electronics, the automotive electronics PCB market is expected to continue to expand. According to Prismark data, the output value of PCBs in the automotive electronics field in 2020 is 6.323 billion US dollars, and the output value is expected to increase to 8.776 billion US dollars in 2025 , the compound annual growth rate is 6.8%, and the growth rate is relatively fast.